I received a CP2000 notice from the IRS. What should I do?

Not your favorite thing to find in the mailbox for sure!

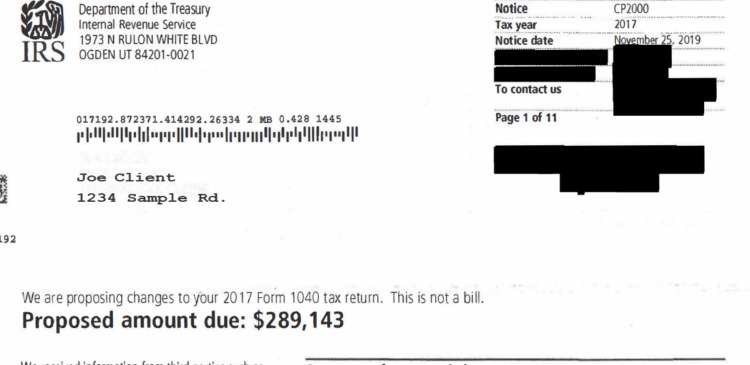

An IRS CP2000 notice is what’s referred to as an “automated underreporter notice”. The notice is sent when the IRS feels that the income and/or withholding information you reported on your tax return does not match the information they have already received from third parties.

Example: if the information on one of your W-2 forms (which your employer also submits to the IRS) does not match what’s on your tax return. Perhaps a mistake was made in preparing the return, or perhaps you forgot to report some income altogether. Or, perhaps a mistake was made by the IRS or by a third party, neither are infallible!

If after reviewing the notice you realize that the IRS is correct, then responding to the notice is straightforward. Simply follow the instructions on the notice to indicate your agreement, sign the notice, and return it to the IRS. I always recommend that any IRS correspondence be sent Certified Mail Return Receipt Requested. Make payment arrangements if applicable.

If you feel that the IRS is incorrect, then you may disagree with the notice. In this case, you should respond to the IRS with documentation to support your position.

When should you get a professional involved? Well obviously, if you’re not sure why you received the notice, and/or are unsure of how to respond. Also, if you disagree with the notice but the IRS does not accept your position, that would also be a time to consult with an expert. Navigating the bureaucracy of the IRS can be confusing and tedious, so transferring that burden to an experienced professional can often be a “best practice”!